Portfolio Workspace

Continuous monitoring and risk management for all your exposures

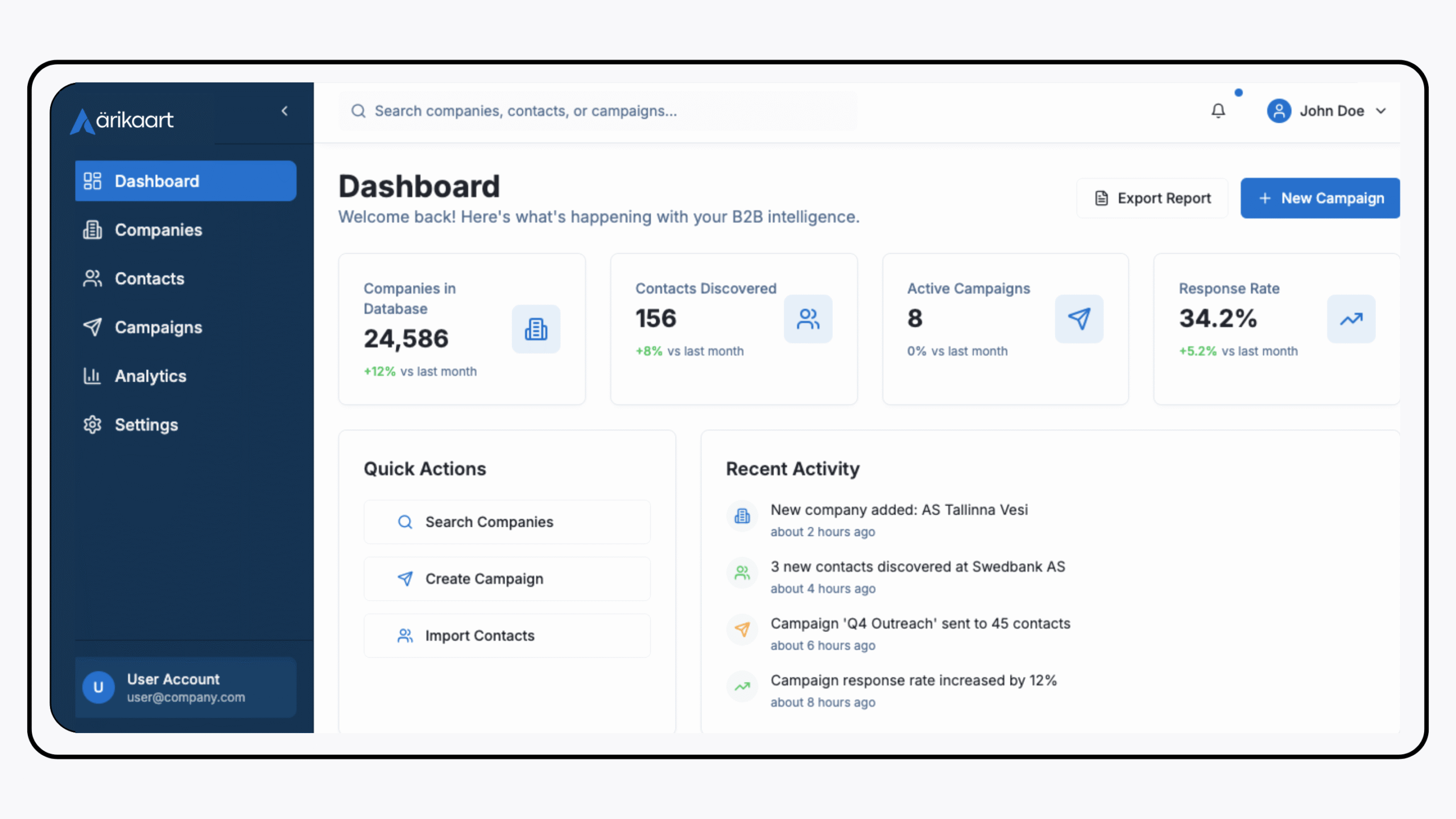

The Portfolio Workspace is the dedicated intelligence layer for investment firms, banks, and enterprise teams managing large, diverse portfolios or vendor exposures across the Baltics, Nordics, and Africa. We transform complex, fragmented motion signals into a unified, actionable dashboard designed for real-time risk assessment and proactive opportunity identification.

Unified asset oversight

The Workspace aggregates and visualizes critical signals from all DataSivio engines, allowing you to monitor assets (portfolio companies, underwriters, key clients) against market motion and emerging risk thresholds.

Integrate and monitor exposures

Effortlessly load your existing portfolio data and immediately link it to DataSivio’s live signals engine.

Custom portfolio upload:

Upload your list of assets, clients, or vendors (by name or registration number) to create a dedicated, private monitoring environment.

Real-time trajectory scores:

Instantly assign a dynamic Expansion or Contraction Score (from the Company Trajectory Engine) to every entity in your portfolio, updating continuously as underlying motion signals change.

Risk threshold alerting:

Set customized alerts based on the Risk Radar findings. Be notified immediately if an asset crosses critical thresholds for leadership instability, procurement loss, or a high-stress score.

Benchmark against market momentum

Do not track your assets in isolation. The Workspace provides instant benchmarking against relevant macro-economic context.

Sector alignment score:

Automatically cross-reference your assets’ activity against the real-time Sector Momentum Engine. See if your portfolio companies are aligned with accelerating sectors or lagging behind.

Regional peer comparison:

View the average Market Pulse and Company Trajectory scores for non-portfolio peers in the same country and sector, ensuring fair performance evaluation.

Opportunity sourcing:

Use the platform’s filtering capabilities to identify new high-momentum, high-growth targets in underserved regional markets to complement existing holdings.

Designed for strategic teams

The Portfolio Workspace is built for collaborative analysis and robust reporting required by finance and investment professionals.

Collaborative workspaces:

Share customized dashboards, reports, and risk summaries with internal teams, investment committees, or underwriting desks.

Data export for reporting:

Easily export validated, time-series data for portfolio companies, including their historical motion and risk scores, to integrate into quarterly investor reports or internal financial models.

Actionable insight generation:

Move beyond simple data visualization. Use the combined motion and risk signals to inform key decisions on capital allocation, hedging strategy, or early intervention with troubled assets.

See all platform features in action

Get started to explore how DataSivio's modules can transform your market intelligence workflow.

Quick links

Follow us

A product of Kontorva. Copyright © 2025. All rights reserved.